Joe Noble, graduate intern at Regen, discusses the role of interseasonal storage in contributing to a net zero electricity system in the UK.

Joe Noble, graduate intern at Regen, discusses the role of interseasonal storage in contributing to a net zero electricity system in the UK.

Installed capacity of wind and solar in the UK is set to rise as we reduce our reliance on fossil fuels. The increased variation in generation, alongside widespread electrification of heat and mobility, increases the need for flexibility in our electricity system. Energy storage is a key source of this flexibility that we need to invest in and more projects with higher energy storage capacity could help iron out some of the discrepancies between supply and demand of electrical energy. This blog post discusses some opportunities and barriers to large volume ‘interseasonal’ energy storage and its crucial role in the net zero pathway.

The current UK energy storage market

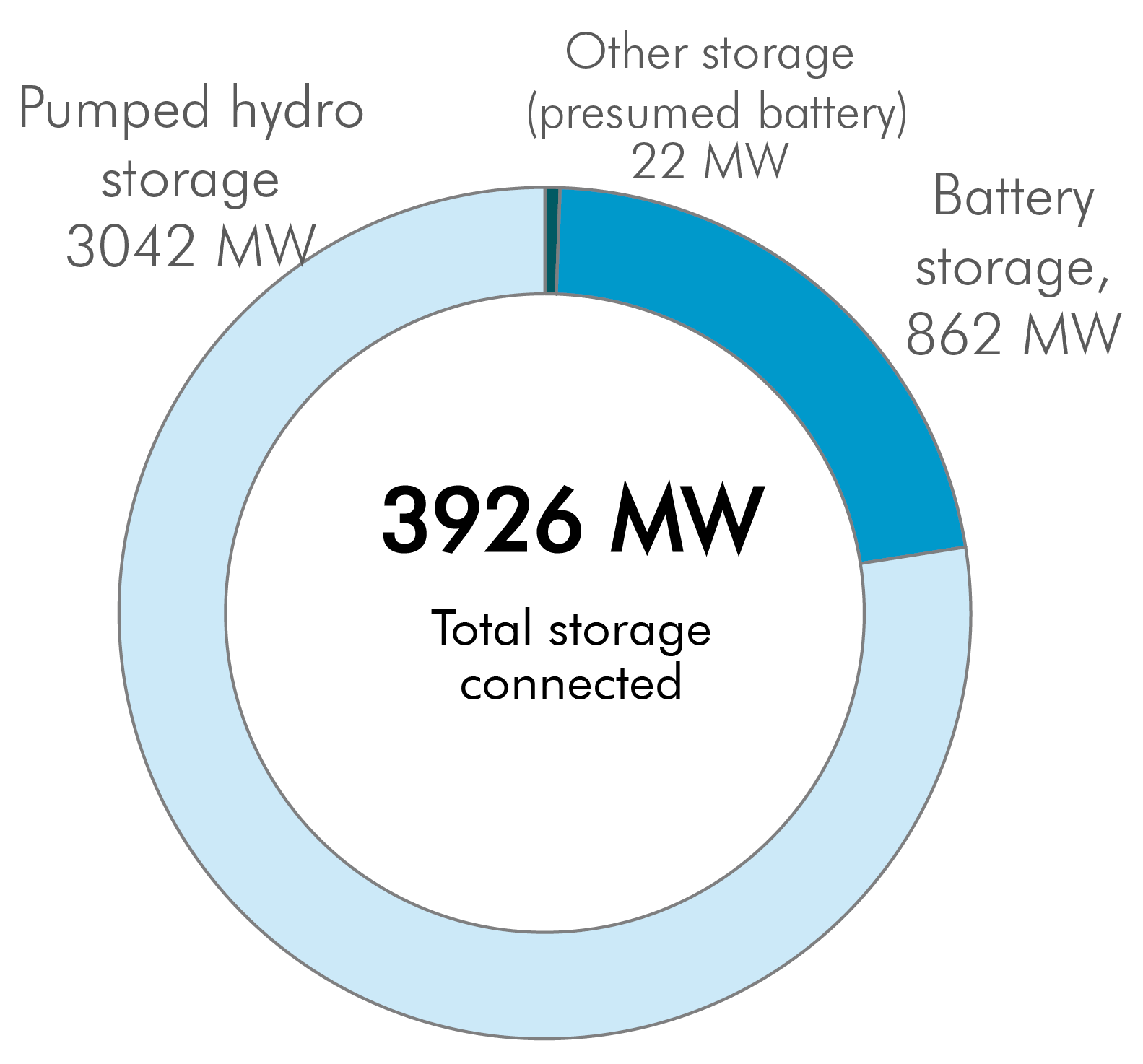

Other than legacy pumped hydro plants, battery storage, with a duration of 0.5 – 2 hours, currently dominates the UK electricity storage market. Short-term battery storage is the go-to choice for developers, due to the revenue streams accessible and the relatively short pay-back time.

Pie chart showing the current split of energy storage grid capacity in the UK[1].

Pie chart showing the current split of energy storage grid capacity in the UK[1].

There is also high ambition in the sector, with over 10 GW of storage in the planning process. Madeleine Greenhalgh, Regen and ESN’s policy lead, discusses the barriers faced by the industry in developing these sites in ESN’s recently published paper, ‘Electricity Storage: Pathways to a Net Zero Future’.

The need for interseasonal energy storage

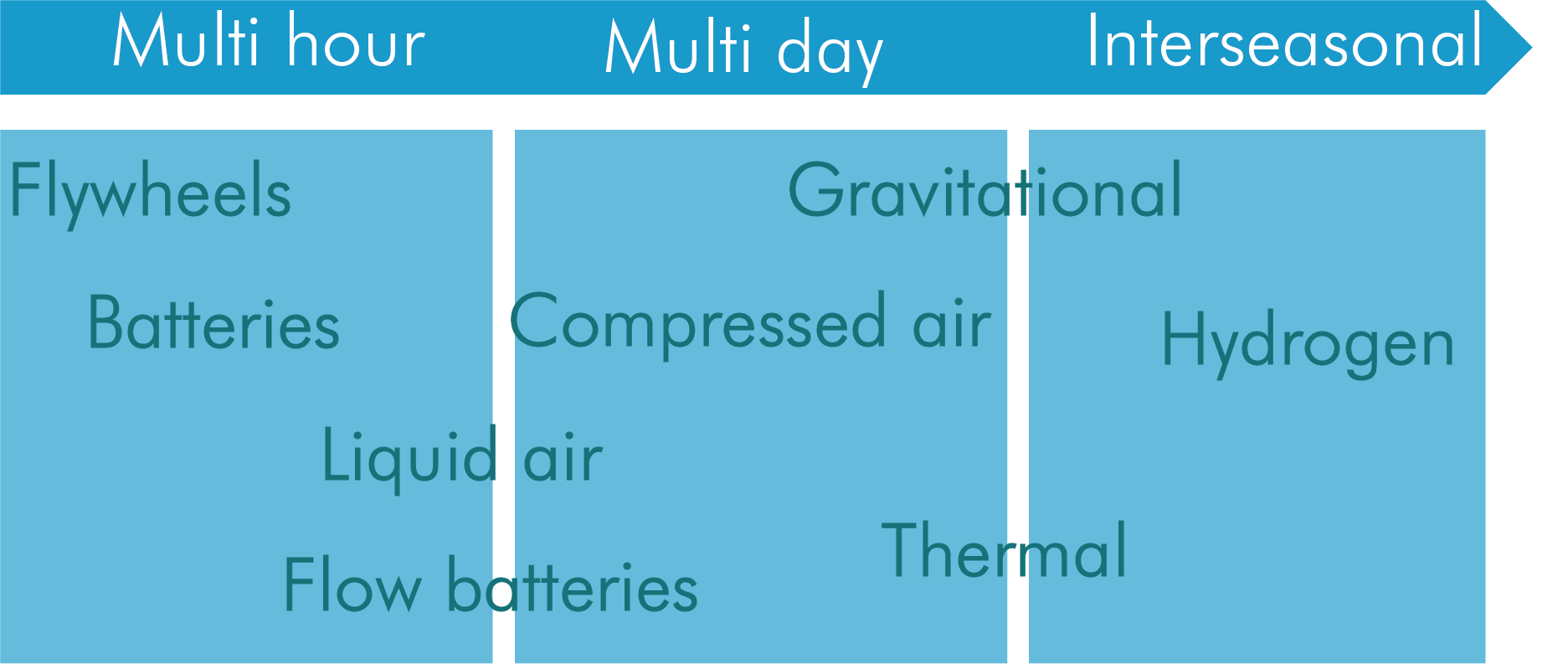

Batteries cater for short term multi-hour needs, and we are increasingly seeing pilots of other technologies which can provide similar or longer duration, such as Highview Power (liquid air), Gravitricity (gravitational) and Invinity (flow battery). Here, ‘long duration’ technologies are classified as having an energy-to-power ratio (duration) of longer than 4 hours. Electricity storage technologies which can store and release power for weeks or longer are referred to as ‘interseasonal’ storage.

Durations catered for by different energy storage technologies[1].

The requirement for interseasonal storage on the UK grid is likely to unfold as penetration of variable renewable energy sources (VRES) on the electricity network increases and demand patterns change. Electric mobility and heat are set to become more widespread as we reduce our dependence on fossil fuels, which will cause an increase in electrical energy demand and volatility, especially in the winter months.

When the wind is blowing, wind power generation profiles in the UK match demand profiles well, peaking in winter. Dependence on variable sources of clean energy would require large volumes of energy storage, such as that offered by interseasonal storage. Solar PV generation peaks around summer, meaning that it does not match demand well in the UK. Solar could see a boost as the UK seeks to diversify low-carbon, low-cost generation sources, and interseasonal storage would facilitate this as it can store large volumes of energy generated in summer, for use in winter.

There are multiple options for system flexibility in a high VRES, net zero scenario:

|

Interconnectors

Electrical connections to neighbouring countries reduce curtailment of intermittent generation and increase security of supply of electricity. The UK has 4 GW of interconnection capacity, which met 9.2% of its energy demand between January and October 2019.[2] An example of a project in development, named IceLink, aims to transmit surplus clean hydro, wind and geothermal power from Iceland to the UK via a 1 GW high-voltage direct current (HVDC) link. |

|

Demand response

Large scale industrial or residential power users could adjust their consumption/behaviour to use otherwise surplus renewable generation. This could be used to run energy intensive processes or supply heat to residential areas, as is being done in a project in the highlands, called 4D heat. The project, run by National Grid ESO and SSEN, aims to use excess, previously curtailed, wind energy to heat homes with electric heating systems. |

|

Carbon capture, utilisation and storage (CCUS)

Larger scale fossil fuel fired generation with CCUS could provide electrical energy at times of stalled low-carbon generation, whilst meeting net-zero ambitions. BEIS are investing £100 million in their ‘Energy Innovation Programme’ to support industrial decarbonisation and CCUS deployment in the UK. |

|

Large scale energy storage

Storing surplus electrical energy for later use offers security of electricity supply, whilst allowing increased penetration of renewables in the energy mix. With a large power capacity, energy stored in a long duration storage asset could help to accommodate winter peaks in demand. It could also ‘fill in the gaps’ during times where the wind isn’t blowing, or the sun isn’t shining. To be viable, interseasonal storage to meet this requirement must be low cost, large capacity and have low losses. BEIS is running a ‘Storage at Scale’ competition with £20 million budget for up to 3 demonstration projects. |

Technology options for interseasonal energy storage

The requirement for long term, large energy capacity storage with low utilisation is what makes seasonal storage an economic challenge. If sufficient value can be accessed through a seasonal price swing, the technology must then be able to store the volume of energy required and dispatch it at the required power capacity.

Electric thermal energy storage (e.g. Siemens Gamesa ETES) and power-to-molecules (e.g. Hydrogen) are the most promising seasonal storage technologies for the future. However, both options have a low level of technology maturity and have low cycle efficiency, causing notable energy losses. Of these, power-to-molecules, such as hydrogen electrolysis and compression, has a much higher energy capacity/duration. Hydrogen also benefits from its ability to be stored and transported with minimal losses, unlike heat and electricity. Large-scale electrolysers are currently running at 75% energy efficiency[3], with increases in efficiency likely as they mature. Conversion of gas infrastructure and appliances to use hydrogen (e.g. HyDeploy) will allow direct use of hydrogen, reducing the requirement for conversion back to electricity, and the associated losses. Both future developments will see the feasibility of hydrogen storage increase.

A recent paper, published in the International Journal of Hydrogen Energy, estimates that hydrogen storage in a depleted UK gas field, the Rough Gas Storage Facility, could output 100 GWh of hydrogen a day for 120 days to help meet peak demand. This hydrogen could be blended into the gas grid or converted back to electrical energy. A project set up to store excess renewable generation on the islands of Orkney using hydrogen, named Surf ‘N’ Turf, offers insight to the feasibility of hydrogen storage systems, albeit on a small scale.

A schematic of Surf ‘N’ Turf, the small-scale hydrogen storage pilot on the Orkney Islands[4].

A key barrier to large scale, long duration energy storage roll out is the high capital costs. The low technology maturity and low utilisation exacerbates the difficulties in creating a business model when accommodating intra-week, month and even interseasonal energy storage requirements. Longer duration energy storage is simply not rewarded in the current markets and products available. The low conversion efficiencies would require access to plentiful, low cost renewable electricity. Further development, dedicated support programmes and considered market design would be needed to encourage technology development and project deployment in the future. These are things that will perhaps start to be discussed more in the future with an increase in the surplus volume of VRES generation.

Barriers to interseasonal energy storage

There are a number of clear and significant barriers to interseasonal storage. These include:

- Long duration and interseasonal energy storage technologies need to be developed further to make them more investable.

- There is a lack of revenue streams from suitable products and markets.

- More VRES installations are needed to produce a large volume of green electricity that is available at low cost. In a recently released paper, analysing 58 climate years in the Netherlands, DNV GL found that the total VRES capacity should be more than three times the maximum demand for a carbon-free scenario. At the end of 2019, renewable capacity in the UK was 37.6 GW[5], and peak load around 60 GW[6].

- CCUS development is being prioritized over interseasonal storage. However, fossil fuels will run out and carbon stores will fill up. If fossil fuel usage were taxed to cover costs of CCUS for a net zero outcome, large scale interseasonal energy storage would become a more feasible option.

Supporting interseasonal storage for a net zero future

As we see increasing ambition under the UK net zero target, interseasonal energy storage could be part of the portfolio of flexibility sources that could help the UK integrate and use more intermittent renewable energy generation. There is currently no real business case for interseasonal storage, and so it will need support in a number of areas. As discussed in our recent paper on energy storage, there needs to be a joint plan between government and industry, including revenue mechanisms that would fund projects beyond the research phase.

Regen and ESN will continue to push the growing need for long duration and interseasonal energy storage with policy makers, as we chart the pathway to net zero. Contact our policy manager Madeleine Greenhalgh to find out more – mgreenhalgh@regen.co.uk.

[1] https://www.regen.co.uk/wp-content/uploads/ESN-Pathways-to-a-Net-Zero-Future.pdf

[3] https://www.powermag.com/worlds-first-integrated-hydrogen-power-to-power-demonstration-launched/

[4] http://www.surfnturf.org.uk/

[5] https://www.gov.uk/government/statistics/energy-trends-section-6-renewables