Capacity Market for a renewable future? Call for Evidence

The government this week released a new call for evidence (CfE) to inform a five year (statutory) review of the operation of the Capacity Market (CM) and Emissions Performance Standard. The CfE, which is open until 1 October 2018, is likely to be followed by a consultation on any changes that are proposed, with the full review due to be completed by summer 2019. BEIS has proposed that changes will likely come into effect in time for the 2019/20 CM auction cycle.

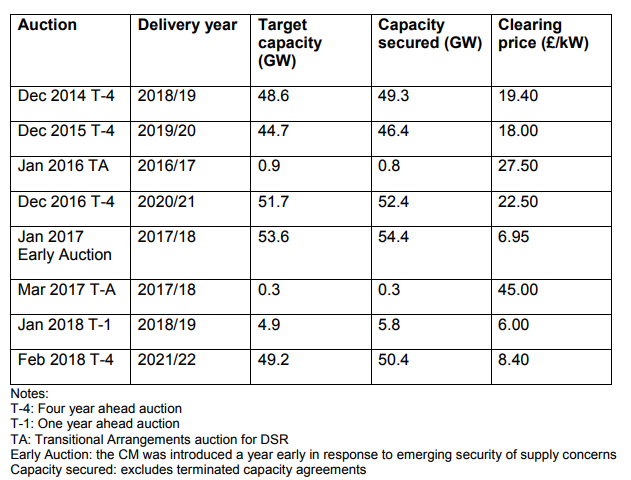

As a reminder, the Capacity Market is essentially a market mechanism to pay generators, storage operators, interconnectors and Demand Side Response (DSR) providers to commit to provide security of supply capacity during a future System Stress Event. It has been run as a series of auctions since 2014 with capacity payments for 1 year ahead (T-1) and 4 year ahead (T-4) commitments, with a 15 year contract available for new build assets.

The scope of the call for evidence is broad but does identify access for renewables and smart technologies as a key priority and Regen strongly supports this.

In its introduction, the government states that it considers the CM to be broadly working in line with its objective to maintain security of supply by a) securing sufficient capacity b) supporting investment in additional capacity and c) ensuring delivery of capacity during future system stress events. The CfE points to the competitiveness of the recent CM auctions, and falling clearing price, as strong evidence that the market is working as intended in a fair and technology neutral way.

BEIS does however acknowledge that, in the context of a rapidly changing energy system, the five year review is a good opportunity to test the premise that the CM is still fit-for-purpose, and to understand how the CM could be further improved to widen participation to new technologies and business models.

Potential impact for renewables, storage and low carbon technologies

Overall Regen welcomes the review of the Capacity Market, particularly since it includes the potential to open the CM to renewable energy generators and explicitly asks the questions of how the CM could “better complement the decarbonisation agenda”. We also see this as an opportunity to restate the case that the CM, and other mechanisms that ensure security of supply and system balancing, need to adapt to meet the challenge of a future more flexible, decentralised and decarbonised energy system. This includes placing greater focus and value on the responsiveness and flexibility of solutions like energy storage, demand side response and local flexibility markets.

From a low carbon and decentralised energy perspective the call for evidence touches on a number of key areas:

1) Allowing access to the capacity market for renewable generation

Building on an Ofgem letter summarising decisions on the amendments to the CM in July[1], BEIS has stated its intention to explore the barriers to enabling renewable energy to participate in the CM.

The potential to allow “non-dispatchable” renewable generation such as solar and wind to participate in the CM, provided they are not in receipt of subsidies, has been under discussion for some time. This move would follow the lead taken in other capacity markets in the EU and beyond and “would be consistent with the European Commission’s Capacity Market State Aid clearance”.

The devil is in the detail however and the CfE highlights a number of points for further consideration including:

- The methodology to de-rate variable generation technologies and how that methodology may need to change over time, as renewable energy market share grows, to ensure security of supply

- How renewable energy generators may be encouraged to enter the CM market as part of “hybrid projects” including, for example, use of storage to deliver security of supply.

- Conversely, how the penalties imposed for non-supply may need to be made more “robust” in order to further encourage non-dispatchable renewable generators to look at hybrid models and “secondary trading strategies”. It is unclear how secondary trading might work for variable renewable generation, but potentially this could open a further market opportunity for storage providers, DSR and aggregators.

So there is definitely a carrot and stick approach developing, whereby post-subsidy renewable energy generators may be allowed to participate in the CM but required, by de-rating factor incentives and/or non-supply penalties, to provide their own back-up/flexibility strategy through storage or secondary trading.

Overall Regen supports the approach to incentivise renewable generators to incorporate storage as hybrid systems or via secondary trading, but this must be in the context of an acceleration of renewable energy deployments and widening access to the CM, rather than the creation of additional barriers.

2) Implications for flexibility providers and energy storage

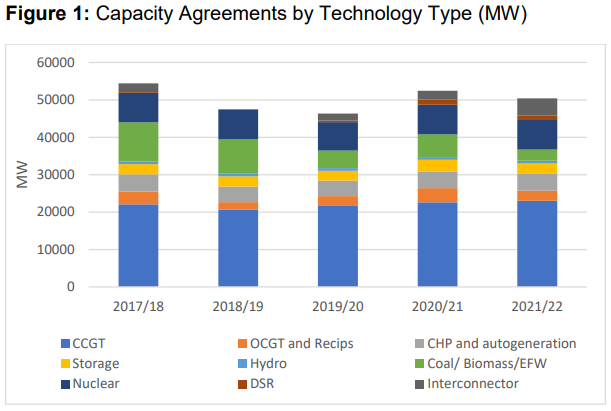

Whilst the capacity contracted has to date been dominated by thermal generation, energy storage and DSR has secured a modest amount of capacity agreements in the CM delivery years to come (see Figure 1).

Figure 1: Capacity Market Capacity Agreements by Technology Type (MW)

Source: BEIS Capacity Market and Emissions Performance Standard Review – Call for Evidence (Aug 2018)

The security value of storage in the CM was scrutinised in 2017, with BEIS consulting on[2] and National Grid enacting[3] a change to the approach for de-rating storage capacity with fixed duration. This saw storage assigned an Equivalent Firm Capacity (EFC), based on the capability of storage assets with finite energy capacity to discharge during the full duration of a system stress event.

We made the point last year that BEIS and Ofgem need to also consider the operational value that storage solution can add during stress events through their fast response capability. Unfortunately the CfE does not present a lot of new specific policy proposals related to flexibility and storage, although it does ask for evidence to support: the participation in the CM by hybrid (storage and generation) projects, the potential augmentation of batteries to increase duration and an increase in the participation of innovative smart technologies including DSR[4].

In the section entitled “Avoiding unintended consequences”, which deals with the recurring issue of “creating a level playing field”, there are a couple of suggestions for policy changes which could have the unintended consequence of reducing investment in smart DSR and behind the meter energy storage.

The three issues highlighted, which have all been raised as “feedback by stakeholders”, include:

- The continued benefit gained by behind-the-meter generators by avoiding balancing service charges, including CM charges, which the Government has committed to consider. Although it would seem perverse, and incredibly difficult, to penalise consumers that have invested in their own energy security in order to ensure that they pay for energy security.

- A proposal to look at de-rating DSR depending on “the technology type of its components” in order to discourage the possible practice of behind the meter storage bidding into the CM in the disguise of DSR.

- The “lighter touch” given to the delivery assurance of DSR providers compared to the more onerous “Satisfactory Performance Days[5]” method to assure physical delivery of generation and storage capacity.

While these are issues which need to be addressed, the direction of travel and suspicion that “stakeholders” is actually a euphemism for vested interests in the industry who would like to restrict market access, raises the risk that policy changes could reduce the incentive for energy users to invest in smart and flexible technologies. This could therefore be at odds with the government’s wider Clean Growth and smart energy agenda.

Interconnectors have also been identified by the whispering voice of “stakeholders”, as potential sources of market distortion and could be in line to have their de-rating factors reviewed on the basis that, as the UK becomes more reliant on interconnection and renewable energy, the likelihood of a stress event being correlated with neighbouring energy systems may increase. Strangely there has been no mention of the likely correlation of a system stress event and running out of gas, as nearly happened when the “Beast from the East” struck northern Europe in March this year. As Regen has previously argued, interconnectors will be critically important to achieve a high penetration of renewable energy and decarbonisation, allowing the UK to export excess wind energy to displace coal on the continent.

Fit for the future?

The CfE asks a number of broader questions about the future of the Capacity Market, whether in fact a capacity market type mechanism will be needed and what role, if any, it should play to support the decarbonisation agenda.

These are good questions to which Regen will be giving some thought in our response and to which we would welcome your input.

As a starting point however we would say that the CM has mainly been about maintaining security of supply by providing an additional incentive to keep existing thermal generation plant capacity available and, to a lesser extent, to support investment in new gas fired generators. As an unintended consequence it has also supported the growth of diesel generators.

For the next decade we will still need gas generation albeit with falling capacity utilisation, and there will therefore probably be a need incentivise gas generators to provide backup capacity. The CM could be one mechanism to do this, however as the level of renewable generation grows and gas is restricted to the role of peaking plant, it is doubtful whether an ever increasing CM payment will be the most efficient and targeted solution. Regen would also question whether providing 15 year contracts for new build thermal plant, without carbon capture and storage, is consistent with the government’s carbon reduction commitments.

The nature of our future requirement for energy security also needs to be considered. The CM has been focused on a particular security issue – a System Stress Event – for which sufficient notice is assumed (minimum four hours) to allow large scale standby generation capacity to swing into action. In fact, although this is one scenario, future energy security events are likely to come from a variety of sources, some with shorter lead times and others with longer duration.

A point that Regen has previously made is that the way future system events are planned and managed, needs to become more sophisticated and flexible. The “Beast from the East” last winter, a prolonged cold spell and increased use of heating that resulted in a near miss in gas supply rather than electricity, brought home the importance of diversity of supply and whole energy system planning. In a smart and flexible energy system diversity of supply, local resilience, speed of response and the ability to harness a much wider range of energy system assets will be important, alongside the ability to call on interconnectors and large scale generation.

Tell us what you think

Regen will be responding to this call for evidence (deadline; 1 October) and we welcome any views from members during this time.

Please provide feedback to Madeleine Greenhalgh, policy and advocacy manager, mgreenhalgh@regen.co.uk.

[1] See Ofgem Decision on Amendments to the Capacity Market Rules 2014 (Jul 2018):

[2] See BEIS “Capacity Market Consultation – Improving the Framework” (Jul 17): https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/631842/CM_consultation_-_detailed_proposals-template.pdf

[3] See National Grid “Duration-Limited Storage De-Rating Factor Assessment – Final Report” (Nov 2017):

[4] See questions 15, 16 and 23

[5] See EMR Delivery Body: “Capacity Market Satisfactory Performance Monitoring” (Apr 2017): https://www.emrdeliverybody.com/Lists/Latest%20News/Attachments/97/Satisfactory%20Performance%20Guidance%20Document.pdf