Johnny Gowdy, Regen’s director, takes a look at the Round 4 Contracts for Difference Draft Budget announcement and its impact on progress towards net zero.

Johnny Gowdy, Regen’s director, takes a look at the Round 4 Contracts for Difference Draft Budget announcement and its impact on progress towards net zero.

Contracts for Difference Round 4 Draft Budget Announcement

£10 million budget highlights great value of onshore wind and solar

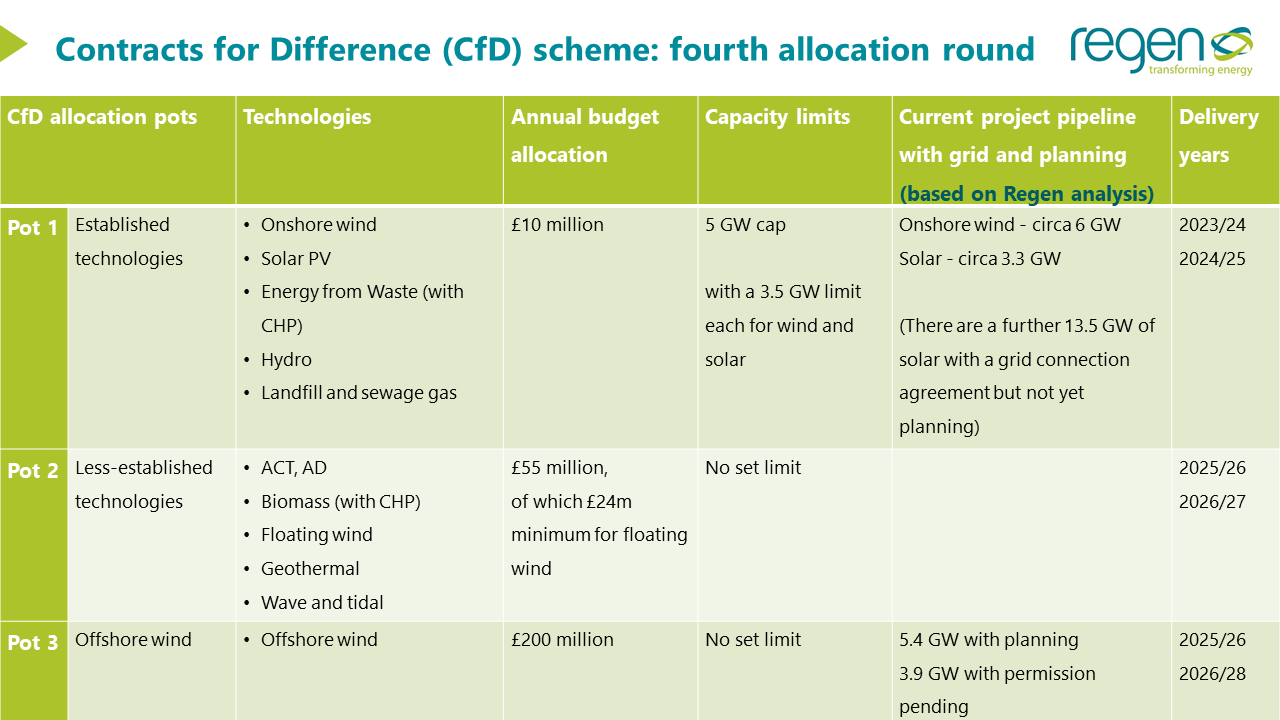

Today’s announcement of an annual £265m levy budget to be allocated to the Round 4 Contracts for Difference (CfD) technology pots confirms that, as expected, offshore wind will receive the lion’s share of the budget with an allocation of £200 million.

It’s most striking, however, that only £10m levy budget has been allocated to Pot 1, which includes onshore wind and solar PV. This could be seen as a snub for these technologies, but it actually reflects the expectation that auction prices for the cheapest renewables will be so low that the government can support gigawatts of new capacity at almost no additional expense to the UK consumer. In other words, rather than a revenue subsidy, the CfD mechanism for onshore wind and solar is more akin to a fixed price guarantee at a very low strike price which will very likely be at or below the prevailing wholesale price. This could be a great deal for UK consumers especially if electricity wholesale prices subsequently rise, requiring generators to pay monies back into the levy budget to reduce consumer bills.

The effective hedge on future price rises provided by renewables contrasts sharply with the National Audit Office estimate of £29.7 billion that will be required to provide a CfD subsidy the Hinkley C nuclear power station over 35 years.

The big question now is whether the award of a CfD will be enough to unlock the 10 GW log-jam of onshore wind and solar projects that are in the pipeline with planning and awaiting construction. A lot depends on the final auction outcome and a very delicate balance between investor’s willingness to give up potential upside revenue from rising electricity prices, as we have seen over recent weeks, in exchange for the greater revenue certainty offered by a CfD strike price. The consensus is that risk-averse investors will be prepared to go low to secure revenue certainty and, if that is the case, the £10 million budget could, in theory, support at least up to the 5 GW limit the government has set for Pot 1.

Costs will be another key factor in the calculation. It’s been well documented that renewable energy costs have fallen greatly since 2015, the date of the last CfD auction that included onshore wind and solar, although in recent months renewables, like other infrastructure projects, have begun to see the impacts of rising commodity costs and other supply chain constraints.

A ‘sensible’ auction price would see the best location projects with the best resources going ahead. There is a risk, however, that, in the heat of a CfD or bust auction frenzy, bids could be pushed below the threshold of financial viability leading to the subsequent drop-out of projects when it comes to financial close.

That’s one of the reasons that, while welcoming the forthcoming auction, Regen has been calling for a much clearer long-term strategy for renewable energy deployment with more frequent CfD auction rounds. This would then allow developers to build their project portfolios, investors to raise capital, utilities to invest in grid infrastructure and supply chain companies to build the jobs, skills and capabilities needed to efficiently deliver net zero.

A final observation: at 5 GW of solar and onshore wind each round we would need annual CfD auctions between now and 2035 to meet our decarbonisation targets. That’s a lot of capacity, but at only £10m budget per round that seems like very good value for money.