As fossil fuel-dependent industries such as heavy transport look towards cheaper low carbon options to help them decarbonise, Regen’s energy analyst Jonathan Lamont assesses the potential future role of one option being considered – e-Fuels – and their viability to help the UK transition to net zero energy.

As fossil fuel-dependent industries such as heavy transport look towards cheaper low carbon options to help them decarbonise, Regen’s energy analyst Jonathan Lamont assesses the potential future role of one option being considered – e-Fuels – and their viability to help the UK transition to net zero energy.

Over the last year, energy price shocks have been experienced across the world at a scale not seen since the seventies. Soaring fossil fuel prices driven by volatility in international oil and gas markets and exacerbated by geopolitical insecurity mean fossil fuel-dependent industries must look to cheaper low carbon options. This blog will investigate one technology that is increasingly being considered – electro-fuels – and its potential future role and viability to help the UK transition to net zero energy.

Electro-fuels (or eFuels as they are more commonly known) are types of synthetic fuels produced by synthesising renewably-produced hydrogen with captured carbon to create a new hydro-carbon fuel. EFuels are a high energy dense liquid fuel that can be ‘dropped-in’ as a direct replacement for existing petroleum fuels used in shipping and aviation and, in effect, offer a chemically identical low carbon alterative to replace oil-derived fuels.

Proponents of eFuels focus on their potential to facilitate low-carbon hydrogen production and support ambitious plans to up-scale renewable energy capacity across the UK. Regen has previously explored this in several blogs: introducing the concept of low carbon hydrogen, exploring the hydrogen value chain and disseminating the UK government’s Hydrogen Strategy.

EFuels could also provide the ‘missing-link’ needed to decarbonise heavy transport sectors, whilst making best use of existing transport assets and abundant low carbon electricity. However, its uptake and future cost reduction rely heavily on improving low carbon hydrogen production practices and large-scale Direct Air Capture (DAC) technologies. There are also questions around whether eFuels will in fact be zero carbon, as well as the high cost and relative inefficiency of eFuel production processes. This ‘efficiency factor’ is further affected by the significant energy demand needed to run a DAC process and capture the required carbon in the first place.

So, are eFuels the missing link, or a costly distraction?

What are synthetic fuels?

Synthetic fuels are carbon-based liquid fuels manufactured via chemical reaction. Production dates back to the early 1900s, with refineries typically using coal or natural gas as a feedstock to convert energy to a liquid fuel, creating considerable quantities of emissions in their production.

The technology is still widely used today: for example, Shell’s gas-to-liquid (GTL) Qatar plant outputs c. 260,000 barrels of GTL products and natural gas liquids per day from natural gas processing[i]. This equates to c. 8% of Shell’s liquid fuel production and is a significant part of the fossil fuel giant’s portfolio of products.

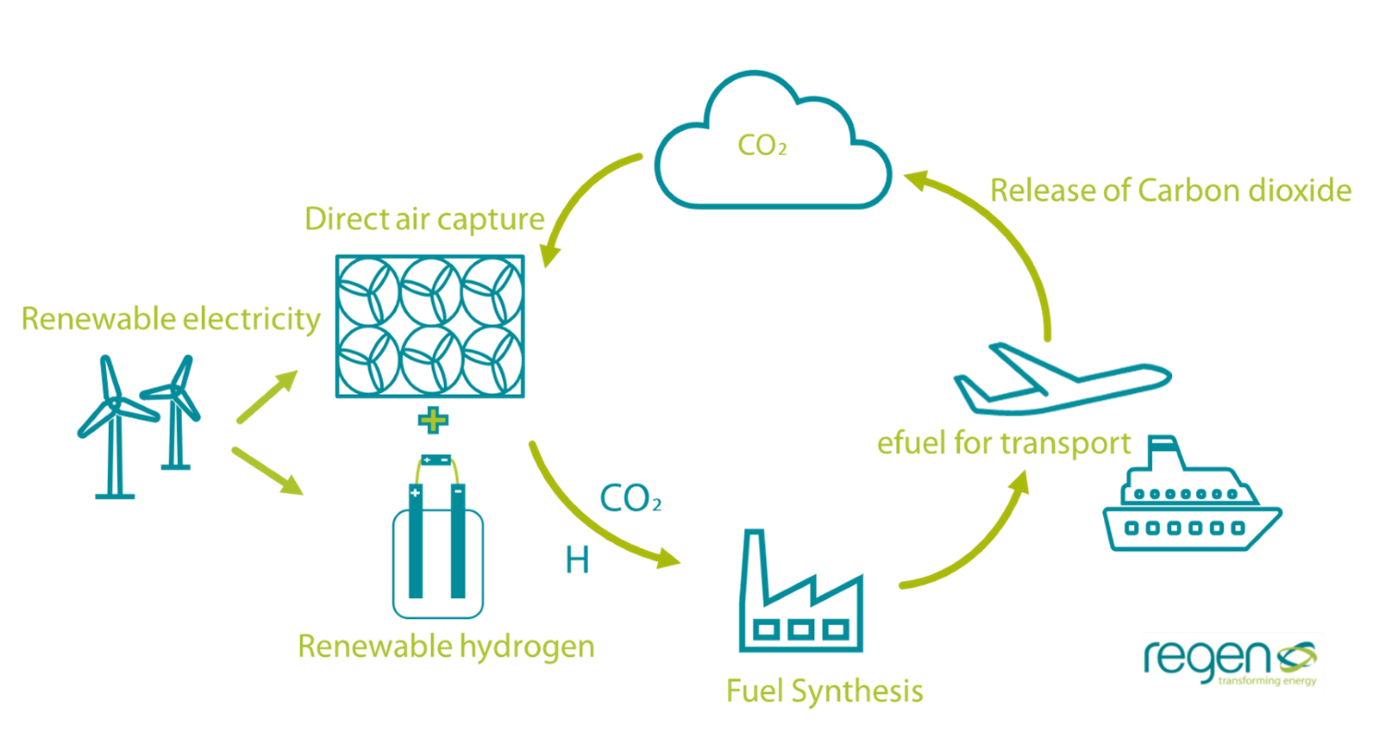

The eFuel production process differs from historical synthetic fuel production, by replacing fossil fuel derived feedstock with renewable energy. Shown in (Figure 1: efuel lifecycle) , the production uses renewable electricity to power an electrolyser, which separates water into hydrogen and oxygen. Direct Air Capture (DAC) technology, powered by renewable generation, extracts carbon dioxide from the air and converts it to carbon monoxide in a reverse Water-Gas Shift reaction. Once converted, it is blended with hydrogen to generate synthetic gas (syngas) as a feedstock for the fuel conversion process. This ‘Fischer-Tropsch’ synthesis process involves a catalytic chemical reaction that outputs a range of eFuels such as eDiesel, eKerosnene or eNaptha. Alternatively, the syngas can also be feed into methanol synthesis to create emethanol for shipping.

Figure 1: efuel lifecycle

Once combusted eFuels release the previously captured carbon, if the carbon is captured directly from a renewable resource (i.e. the atmosphere or biogenic) and the hydrogen electrolysis and capture processes are powered by renewable energy, it can be claimed that the full lifecycle of production and usage of the eFuel is carbon neutral.

If produced correctly, the low carbon potential of eFuels could, therefore, see it play a niche but important role in solving very difficult to abate sectors.

A solution for decarbonising heavy transport?

As the highest emitting sector of the UK economy, solving the challenge of decarbonising transport, in particular high-carbon heavy transport sectors such as aviation and shipping, is one of the greatest challenges the UK faces on the path to net zero.

Over the past decade, debate has focused on the benefits and drawbacks of electrification and hydrogen (fuel cell and combustion) to decarbonise the aviation and shipping sectors which, despite a lull due to the pandemic, are forecasted to have a surge in demand in the coming decades[ii].

Challenges for electrification have arisen from the relatively low energy density of solid-state batteries making them less suitable for larger, weight-sensitive transportation. Hydrogen fuel cells could avoid the long charging times and frequent replacement that electric batteries require, but hydrogen’s lower volumetric energy density would require a larger tank space.

Although both battery electric and hydrogen fuel cell technologies are in the relatively early stages of development for heavy transport applications, they are expected to reach the mainstream market over the coming decades, with each likely to play some role for certain applications. However, these options are not an immediate mitigation option, nor do they address the substantial sunk costs in existing infrastructure.

This has industry assessing various other technologies in an attempt to decarbonise heavy transport, including eFuels.

The benefits

EFuels may be able solve some of the issues for decarbonising aviation and shipping, which hydrogen and electrification have initially struggled to resolve.

As eFuels have a much higher energy density than hydrogen and can be stored at room temperature and pressure, they have the ability to act as ‘drop-in fuels’ in the existing fossil fuel supply chain and propulsion systems. Specifically, as they are able to integrate into existing filling stations, refineries, storage tanks etc., eFuels could allow for a rapid and seamless transition to meet some demand for low carbon fuel.

This could make eFuels important for airlines and shipping which have a large existing combustive engine fleet. Substituting eFuels into existing assets (such as ships, aircrafts and industrial engines) rather than scrapping them – which would be necessary in the case of other heavy transport decarbonisation options – would avoid the cost and carbon emissions associated with replacing a fleet of vehicles.

This has convinced industry groups to pledge to incorporate synthetic fuels into their operations, with 60 airline organisations having pledged to accelerate the supply and use of sustainable aviation fuel (SAF) to reach 10% of total global jet aviation fuel supply by 2030[iii]. These developments have led to the construction of the world’s first large-scale eFuel plant in Chile, expected to be operational by 2023 and produce 550 million litres of eFuels by 2026[iv] – a modest output for an industry forecasted to consume 317 billion litres in 2022[v].

The drawbacks

Though eFuels have their advantages, the production method presents a number of barriers that could prevent efficient and cost-effective adoption into the low carbon fuel market:

- Efficiency: Firstly, a number of papers have looked at the lifecycle efficiency of eFuel production, from the processing of the feedstock to the final eFuel. The International Council of Clean Transportation calculated that the total conversion efficiency throughout the process could be as low as 16%[vi]. This is partly due to the inherent inefficiency of the internal combustion engine and partly explains the low value. It remains an issue for the conventional fuel industry.

- Energy demand: Secondly, the energy requirement is significant. The UK aviation industry consumed 13.7 Mtoe (159 TWh) of jet fuel in 2019 according to BEIS[vii]. Taking into account the inefficiencies of the eFuel production process, the required renewable generation for eFuels to solely decarbonise the aviation sector would total 717 TWh. To put this figure into context, UK renewable generation for 2020 amounted to 135 TWh. A similar point has been found by the International Chamber of Shipping (ICS)[viii], which estimates that the use of eFuels to decarbonise shipping would require the world’s current total of renewable generation.

- Costs: Finally, The Royal Society found prices of eFuels are roughly 3-5 times higher than conventional fuels[ix]. Recent price spikes have made eFuels relatively more affordable; however, there would still need to be significant production cost reductions and an effective carbon tax on conventional fuels to make this cost comparable. Confidence within the industry has grown that the price of production will fall significantly as plants scale up and take advantage of economies of scale. In particular, the cost of hydrogen electrolysers is expected to fall significantly[x]. However, the efficiency losses involved in conversion of electricity to hydrogen and hydrogen to eFuel will mean that they are likely to remain inherently expensive.

What’s the conclusion?

EFuels represent one option alongside the more familiar technologies of battery electric and hydrogen fuel cell vehicles, but heavy transport will not be a single solution industry. Whilst eFuels are no panacea and are unlikely to entirely replace conventional fuels, they will have a role to play as part of a diverse energy mix for heavy transport, where electrification, hydrogen and synthetic fuels will all contribute to decarbonising specific segments of the market.

While their ability to perform and act in the same conditions as conventional fuels means they offer an attractive solution in the short term, it does come at a cost. This is a quandary that industry consumers and producers must address: whether they want to accept the higher unit cost but utilise carbon neutral fuels that enable the use of a global pre-existing network, or take a lower unit cost of hydrogen and face the higher capital costs of constructing or repurposing a hydrogen supply network.

[i] The world’s largest gas-to-liquids plant | Shell Global

[ii] https://www.airbus.com/en/products-services/commercial-aircraft/market/global-market-forecast

[iii] https://www.weforum.org/press/2021/09/clean-skies-for-tomorrow-leaders-commit-to-10-sustainable-aviation-fuel-by-2030/

[iv] https://newsroom.porsche.com/en/2021/company/porsche-construction-begins-commercial-plant-production-co2-neutral-fuel-chile-25683.html

[v] https://www.iata.org/en/iata-repository/pressroom/fact-sheets/fact-sheet—fuel/

[vi] https://theicct.org/e-fuels-wont-save-the-internal-combustion-engine/

[vii] https://www.gov.uk/government/statistical-data-sets/energy-and-environment-data-tables-env

[viii] https://www.offshore-energy.biz/shippings-future-fuel-demand-equal-to-entire-current-global-renewables-production-data-shows/

[ix] Policy briefing: Sustainable synthetic carbon based fuels (royalsociety.org)

[x] https://www.energy-transitions.org/wp-content/uploads/2021/04/ETC-Global-Hydrogen-Executive-Summary.pdf