Madeleine Greenhalgh, policy and advocacy manager at Regen and the Electricity Storage Network (ESN) introduces the latest paper from the ESN: ‘Electricity Storage: Pathways to a Net Zero Future’

Madeleine Greenhalgh, policy and advocacy manager at Regen and the Electricity Storage Network (ESN) introduces the latest paper from the ESN: ‘Electricity Storage: Pathways to a Net Zero Future’

The Electricity Storage Network has released a report outlining the role storage can play in tackling the climate emergency. As the UK looks to a green recovery from the pandemic, the paper calls for a clear signal from government to set a trajectory for storage over the next decade which will help create jobs and economic growth while enabling the electricity system to become zero carbon.

The paper has been built from a broad evidence base, building on our extensive engagement with ESN members and wider industry, government, Ofgem and National Grid ESO. Regen has written two previous major reports on storage in 2016 and 2017 and this paper builds on those findings, aiming to give an overview of storage and its uses, a snapshot of where the industry has got to in 2020, and what needs to change if we’re to face up to the climate emergency over the next decade.

The paper outlines six key recommendations for government and industry to ensure we build a sustainable industry that allows storage to deploy at the scale needed to support the UK’s transition to net zero.

How is the storage industry developing?

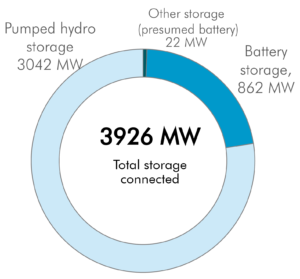

Looking back over the last few years, we have seen the amount of storage on the system increase to 4 GW, with over 850 MW of battery storage connecting to both the transmission and distribution networks. Data on storage has always been quite difficult to obtain, beyond the known pumped hydro installations, but with the release of the DNO’s System Wide Resource Registers (SWRR), we’re able to get a much more accurate picture of what is connected where (and not just for storage). This is a great step forward in transparency for the industry and we are keen to see these data releases develop.

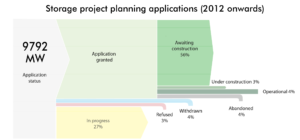

The other key database for assessing deployment is the Renewable Energy Planning Database (REPD), released by BEIS. Whilst there are some inconsistencies between the RPED and the DNO and National Grid registers, we are able to get a broad picture of what projects are going through the planning process and which are succeeding. Crucially, we found that while there is a high level of ambition, with nearly 10 GW of storage in the planning process (excluding existing pumped hydro), 56% of those are still awaiting construction, despite having a planning application granted.

What is stopping these projects from deploying?

The business model of storage asset is made up of several blocks, stacked together to form a whole business case and so the economics of these projects have always been tricky to get right.

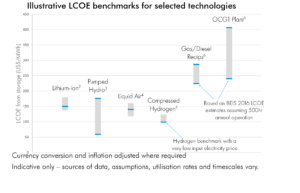

But the overall costs of storage projects are coming down quickly – lithium-ion batteries are now cost competitive with fossil fuel ‘peaking’ technologies that perform a similar service for the electricity system and costs are likely to fall further.

But the overall costs of storage projects are coming down quickly – lithium-ion batteries are now cost competitive with fossil fuel ‘peaking’ technologies that perform a similar service for the electricity system and costs are likely to fall further.

So if costs are falling, why are projects not being built? We’ve identified several barriers that are slowing the deployment of storage – if unlocked, we could see storage increase to the levels needed to enable a net-zero system.

Barriers to storage

One of the fundamental issues affecting the storage sector is the lack of legal framework – at present storage is, by default, treated as a subset of generation, with rules tweaked to make them more appropriate for storage. We believe that without a legal framework, storage is stuck in limbo and must therefore be included in the electricity licence framework.

One of the fundamental issues affecting the storage sector is the lack of legal framework – at present storage is, by default, treated as a subset of generation, with rules tweaked to make them more appropriate for storage. We believe that without a legal framework, storage is stuck in limbo and must therefore be included in the electricity licence framework.

The government are supportive of storage and recognise its role in the net zero transition, but we need a longer-term plan that gives the whole industry, including investors, confidence in the direction of storage over the next few years. The government should set a clear signal for the trajectory for storage over the next decade.

The government are supportive of storage and recognise its role in the net zero transition, but we need a longer-term plan that gives the whole industry, including investors, confidence in the direction of storage over the next few years. The government should set a clear signal for the trajectory for storage over the next decade.

Long-duration storage is now starting to be talked about in earnest in industry circles and there is acknowledgement that it will be needed in future to support a net zero system. However, there is currently very little in the revenue stack that would reward longer duration or seasonal storage. Government and industry must develop a joint plan for long-duration storage, including revenue mechanisms that would fund such projects beyond the research and development phase.

Long-duration storage is now starting to be talked about in earnest in industry circles and there is acknowledgement that it will be needed in future to support a net zero system. However, there is currently very little in the revenue stack that would reward longer duration or seasonal storage. Government and industry must develop a joint plan for long-duration storage, including revenue mechanisms that would fund such projects beyond the research and development phase.

As we transition to a net zero, sustainable future, we must ensure that the vital industries we are building to solve the problem are also sustainable. It’s widely known that there are environmental and human rights concerns with the extractive industry that provides the minerals required to support battery storage. There many solutions available and currently being implemented to address supply chain issues, but industry and government need to work to increase awareness of supply chain challenges, working towards a supply chain standard that the industry can adopt.

As we transition to a net zero, sustainable future, we must ensure that the vital industries we are building to solve the problem are also sustainable. It’s widely known that there are environmental and human rights concerns with the extractive industry that provides the minerals required to support battery storage. There many solutions available and currently being implemented to address supply chain issues, but industry and government need to work to increase awareness of supply chain challenges, working towards a supply chain standard that the industry can adopt.

Business rates for storage projects are currently very high and make up a significant proportion of the business case for storage, particularly for behind-the-meter assets. The government should provide business rates relief to storage providers who are key to the transition to net zero.

Business rates for storage projects are currently very high and make up a significant proportion of the business case for storage, particularly for behind-the-meter assets. The government should provide business rates relief to storage providers who are key to the transition to net zero.

And finally, markets, which are the key revenue source for storage, are set up to facilitate large, incumbent providers accessing the system. Market barriers must be eliminated to fully value the services that storage can provide and flexibility markets should value carbon and provide transparent reporting on the carbon intensity of all services.

And finally, markets, which are the key revenue source for storage, are set up to facilitate large, incumbent providers accessing the system. Market barriers must be eliminated to fully value the services that storage can provide and flexibility markets should value carbon and provide transparent reporting on the carbon intensity of all services.

Read the paper here: