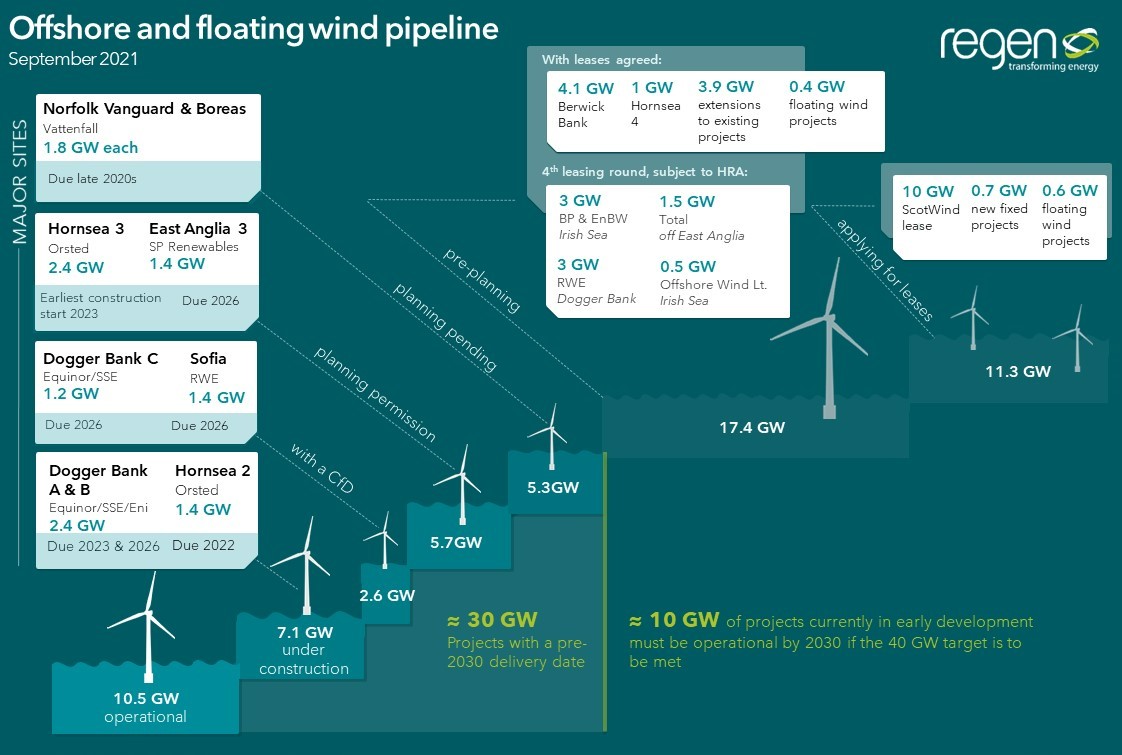

“On paper” pipeline in place to deliver 40 GW by 2030, but an expansion of offshore wind in the west will be needed for 2035 net zero target.

Regen’s analysis suggests that, on paper, the offshore wind development pipeline should be able to meet the UK’s 40 GW by 2030 target. However, success is not certain, it will depend on a ramping up of deployment to 3 GW a year, and no delays to future projects caused by network infrastructure availability, supply chain constraints or planning delays. New additions to the pipeline, probably through a new “Round 5” leasing process, will be required to meet the UK’s broader commitment to a net zero electricity sector by 2035. This will very likely feature a much greater role for floating wind and the development of new areas of ocean on the western seaboard such as the Celtic Sea. Demonstration sites in the area have secured leases, with more to come. These could be the forerunners to several projects located in Welsh, Cornish and Irish waters. If exploited fully, this could lead to tens of gigawatts of deployed capacity.

A lot will depend on the delivery of the Crown Estate’s 8 GW 4th Leasing Round, announced in February 2021, and the ScotWind projects. The ScotWind lease has seen 74 applications submitted for 15 areas of seabed, with winners to be announced in early 2022. Oil and gas majors feature heavily and intend to develop the first large scale floating wind sites. Regen has previously commented on the increasing involvement of oil majors in the new lease rounds:

https://www.regen.co.uk/big-oil-raises-the-stakes-in-uk-offshore-wind-market/

While oil and gas majors are no stranger to offshore wind, with leading developers Orsted and Equinor being reformed majors DONG and Stratoil, the fresh faces of BP and Total introduces the question of whether they can bring a new approach to project development and construction.

Thus far, Total have bought into existing projects, firstly acquiring an 80% stake of the Erebus floating wind demonstration site, and subsequently a 51% stake of Scotland’s 1.1 GW Seagreen wind farm. The Round 4 site will be their first run at cradle-to-grave offshore wind development. For their bid, BP have partnered with experienced German developer EnBW, who operate offshore sites in the German Baltic and North Sea.

The 4.1 GW Berwick Bank site, located east of Edinburgh and developed by SSE Renewables, is one of the largest offshore projects globally. A planning application is expected to go before Scottish government in Spring 2022.

The 3.9 GW of extensions comprises six projects around England and Wales. Significantly, in an industry first, Sheringham Shoal and Dudgeon extensions off the Norfolk coast will be sharing a onshore grid connection footprint and submitting a shared Development Consent Order. The government hope to encourage this more collaborative approach through their Offshore Transmission Network Review, which Regen has summarised in its briefing note, below.