Jonathan Lamont, graduate intern at Regen, analyses the recent rises in wholesale electricity prices and its impact on Contract for difference (CfD) subsidies for onshore wind projects.

Jonathan Lamont, graduate intern at Regen, analyses the recent rises in wholesale electricity prices and its impact on Contract for difference (CfD) subsidies for onshore wind projects.

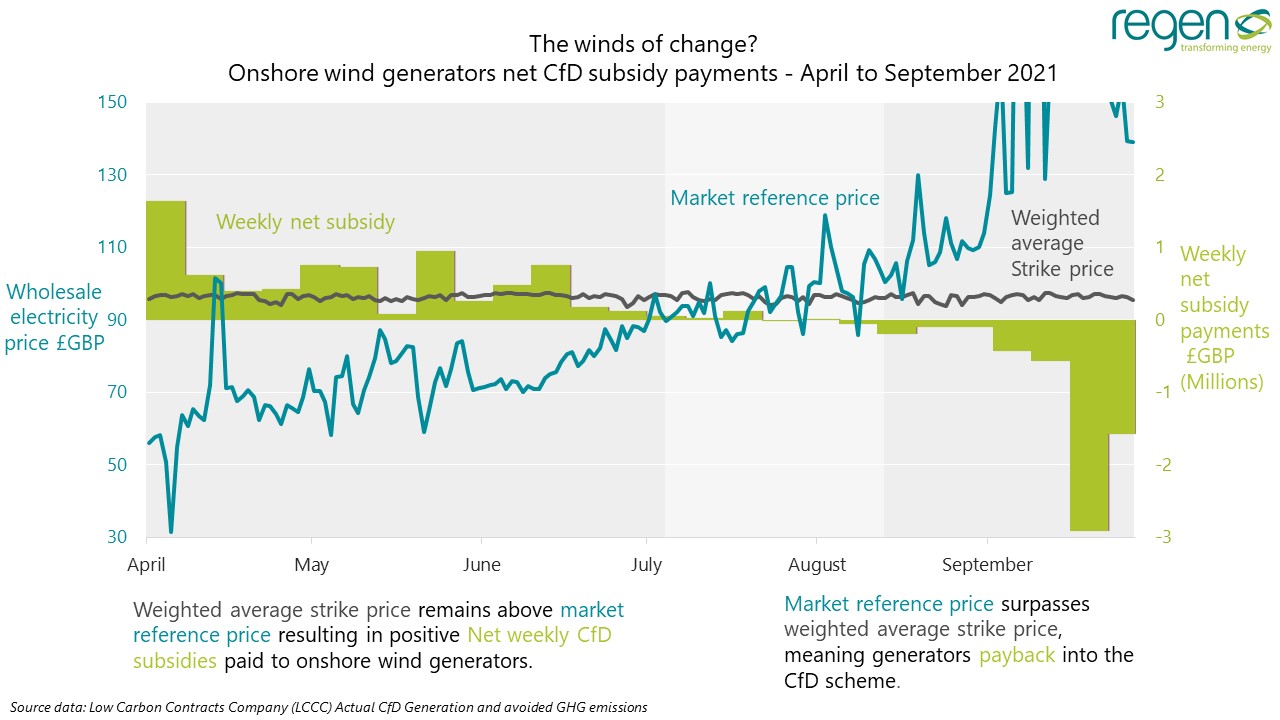

The energy crisis of September 2021 has been a stark reminder of the vulnerability of the UK energy system because of its continued dependency on fossil fuels. Culminating in collapsing supply companies, inflated gas prices and dry petrol pumps, the knock-on impacts of rising gas prices included an extreme period of volatility and high wholesale prices for electricity. However, in the case of renewable electricity there has at least been a small, but potentially significant, silver lining. The rise in electricity prices resulted in a new phenomenon of some renewable energy projects paying back subsidies thereby, in effect, reducing consumer bills. This happens for Contract for Difference (CfD) contract holders when the market price is greater than their CfD subsidy strike price or, in other words, when the “difference” they would normally receive as a subsidy payment is negative.

Regen’s analysis, in the chart above, shows the switch from positive to negative subsidy payments that has occurred over the last six months as the market reference price (which is based on the day-ahead auction price for intermittent electricity) regularly exceeded strike prices for those onshore wind and solar projects holding a CfD. In September alone, the 13 onshore windfarms holding CfDs paid back £5.5 million to the low carbon levy funds, reducing the overall environmental levy cost which currently makes up a quarter of consumer electricity bills. Our analysis of solar PV CfD holders shows a similar trend. This is a small contribution compared to the billions of subsidy payments that have been made, but with energy prices expected to remain high and future CfD auctions expected to be even more competitive, this payback feature could become the new normal.

As we have previously highlighted1, the occurrence of subsidy payback from generators to consumers means that the UK has an opportunity to exploit the falling costs of renewable energy to hedge against rising fossil fuel prices while at the same time meeting our climate change commitments. Regen has therefore called on the UK government2 to take this opportunity to double the deployment of renewable energy at the next CfD auction round, and to massively increase the rate of deployment throughout the next decade.

1 Let’s take advantage of low-cost renewables to create a hedge on energy price rises

2 Call for BEIS to double the capacity of renewables in 2021 Contracts for Difference auctions