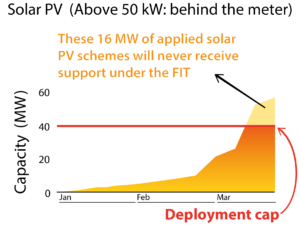

A last minute spike in applications for the Feed-in Tariff (FIT) has breached the 41 MW cap for behind-the-meter solar PV installations over 50 kW.

In our February Market Insight Report, we highlighted the caps and gaps in deployment in the final quarter of the FIT. At that point, there was still 30 MW of capacity available for behind-the-meter solar PV above 50 kW – this has been filled in just two weeks following this assessment, with 16 MW of applications missing out. There was always going to be a last minute race for FIT payments in the final quarter, but the number of applications and amount of capacity in the >50 kW category has been surprising. We think this is likely to be businesses wanting behind-the-meter generation that are able to quickly push through a FIT application at the last minute.

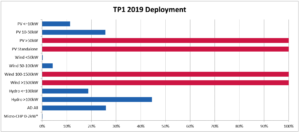

The Standalone PV category with a 5 MW cap has been queued for some time and was reached almost immediately in this quarter. Wind over 100 kW (11 MW cap) was also in a similar position and reached its cap very quickly. However, smaller wind and solar still have a significant amount of capacity left in their caps – total of 522 MW.

It will come as no real surprise that hydro, AD and Micro-CHP are also far from reaching their deployments caps – 69.4 MW of spare capacity is waiting to be filled.

Source: Ofgem Deployment Update 22 March 2019

Source: Ofgem Deployment Update 22 March 2019

How many projects will be missing out?

77 projects, totalling 32 MW of solar and 21 MW of wind will now not be awarded FIT contracts. Ofgem were very clear that once the capacity limits were reached, there would be no extensions for those in the queue.

With an unquantified hiatus between the FIT ending and the Smart Export Guarantee beginning, the chances of those projects going ahead will very much depend on how much they are able to self-consume to make the business model stack up.

If these projects don’t go ahead, we could be sacrificing a sizeable amount of new renewable generation, plus a missed opportunity for those businesses that are trying to decarbonise, save money on their bills and improve their energy consumption. During a very difficult and uncertain period for businesses, this will not be a welcome development.

What will happen to the spare capacity?

Given that this is the last possible opportunity to receive the FIT, there is talk in the industry of pushing BEIS and Ofgem to reallocate spare capacity to those who have missed out. This seems unlikely given the government’s desire to reduce FIT costs as much as possible.

This last minute dash just shows how much the closure of the FIT has rocked the industry. The delay from government officially announcing the closure and still not having a full plan in place for its replacement has left many unprepared. Poor communication from Ofgem on the caps has meant that some technologies have had a last minute scramble, while others are left languishing.

We await news of the Smart Export Guarantee with bated breath and those with projects that didn’t make the cap will now be impatient for its arrival