Distribution networks seeking flexibility

As part of the transition to Distribution System Operator (DSO), many of the UK Distribution Network Operators (DNOs) are currently exploring the potential to procure flexibility services as an alternative to reinforcing the network. These services are to be provided by Distributed Energy Resources (DERs) – assets that are connected to and operating on their networks, including generation assets, energy storage and the ability of demand customers to turn down (or turn up) upon request.

From design and signposting consultations, calls for expressions of interest (EOI) and formal tenders, several of the DNOs are beginning to follow through on their regulatory requirements of enabling and facilitating a market for local flexibility services. In recent months UK Power Networks (UKPN), Western Power Distribution (WPD) and ENW (Electricity North West) have taken the next step by formally engaging with the market through EOI or tender processes.

- Building on their 2017 EOI[1] and follow-up tender in 2017, UKPN has recently instigated bi-directional contracts with a small number of flexibility providers. One of the parties is domestic battery company Powervault, who will provide flexibility services through a portfolio of 40 8kWh batteries across the London Borough of Barnet[2]. UKPN has also committed to publishing a forward-looking roadmap for flexibility service needs out to 2023[3].

- ENW is currently reviewing the EOI received from a recent call for flexible services for 2018/19[4]. This call discussed seven locations in the north west, including Alston, Coniston, Easton, Nelson and various districts of Manchester. ENW is due to provide an update on the results of this EOI and it will be interesting to compare the level of response received, types of technology/service and volume of flexibility that is hoping to participate in these areas.

- WPD is now progressing further with its Flexible Power programme, with trial areas, a completed EOI and plans to move flexibility tenders forward for constraint areas in their licence areas. We explore the outcome of WPD’s EOI in more detail in this blog.

Whilst there are similarities in the way that these DNOs are turning to the market for flexibility, there are also some difference in the approach taken to, for example:

- Setting out pricing/price structure

- Classifying different types of flexibility service

- The approach to setting a baseline

- The method of verifying a dispatch

- The type/volume of information that is made available up-front to potential market entrants

Its all about managing demand (so far…)

A consistent theme across the first tranche of calls, is that they are all looking to manage demand peak-driven constraints in the network, not generation constraints. The reason behind this is related to the structure of the DNO regulatory framework. In essence, DNOs are not able to pass network upgrade costs relating to increased demand on to the connecting customer(s). The DNOs make these investments themselves, through their regulated capital. It is therefore an option for a DNO to turn to the market, incentivising flexibility providers to help them to reduce demand peaks, deferring network upgrades. With a likely significant and rapid increase in electric vehicles (EVs) and further heat pump uptake, it should be considered that these investments in the network will likely need to happen at some stage. There are however benefits to deferment, such as a reduced cost of capital, opportunities to exploit economies of scale when upgrades are made and more certainty/accuracy around proposed future sources of electricity demand, i.e. housing or industrial estate developments.

For generation seeking to connect however, the DNO is not under the same requirements. Under the current charging framework, connecting generation assets are required to bear the wider network reinforcement costs that are triggered by their project and/or accept an alternative connection offer. Examples of alternative connections include; export limitation, timed connections or Active Network Management (ANM). However, if Ofgem’s proposed changes[5] to make connection charging ‘shallower’ come to fruition, the DNOs may no longer be able to pass the full upgrade costs onto generators. This could result in DNOs turning to the market to mitigate generation-constrained network areas as they are currently doing for demand peaks. However, with a suite of alternative connections and ANM available to offer a generator, the requirement for generation turn-down/demand turn-up flexibility services may be more limited or only required in specific areas.

WPD Flexible Power

WPD’s approach and activities to date have been a good indication of this emerging market and the processes that may sit behind it. Under the Flexible Power brand, which trialled to seek flexibility services in the Midlands last year[6], WPD issued an EOI for flexibility services across its network in June. This EOI outlined flexibility needs in 18 Constraint Managed Zones (CMZs) across five areas, for this winter and into summer 2019. WPD has referenced three discreet types of flexibility service; Dynamic, Secure and Restore, which we summarised in a blog back in June. WPD also stipulated some specific entry/operating requirements, with entrants needing to be within one of the CMZs, have half-hourly metering and minute-by-minute monitoring, able to respond to meet a 15-minute notification and sustain flexibility response for at least two hours.

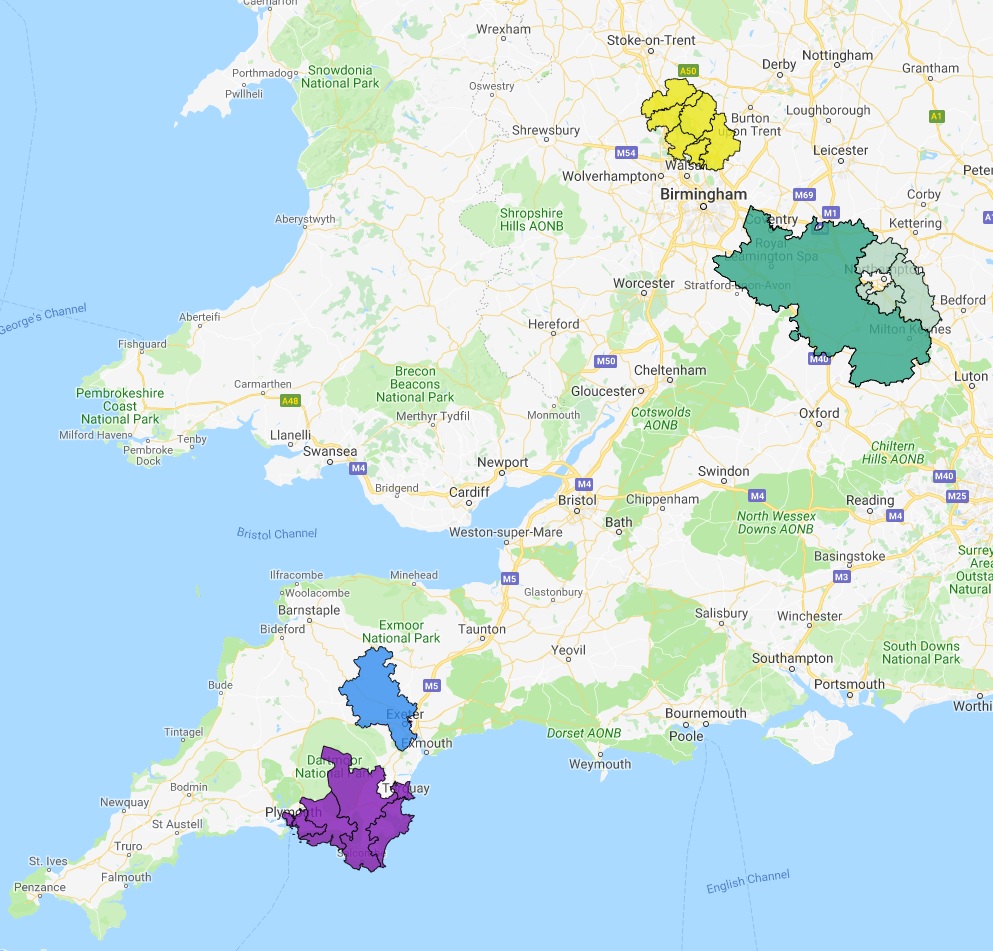

The results of this EOI have now been published, with WPD announcing an intention to take 16 of the 18 CMZs forward through to tender. The two CMZs in the Beaumont Leys area have been removed, which could potentially be related to receiving too few or non-compliant responses, but the specific reasons are not specified. See Figure 1.

Figure 1: WPD Network Flexibility Map showing constraint areas being taken forward to procurement (Source & credit: WPD)

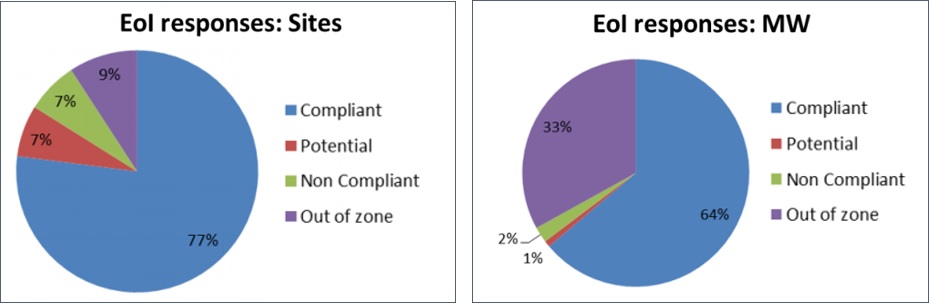

A summary analysis of the response is as follows:

- Overall response to the EOI totalled 87 sites, offering 261 MW of flexible capacity

- The response was as a mixture of generation turn-up, demand reduction and energy storage

- 64% of the capacity (67 sites, 167 MW) that responded was wholly compliant, whilst:

- 33% of the capacity (8 sites, 86 MW) was located outside of the advertised zones

- 2% of the capacity (6 sites, 6 MW) was classified as ‘non-compliant’, potentially relating to factors such as the type of technology, flexible capabilities and the feasibility of the site meeting a 15-minute response and two-hour duration.

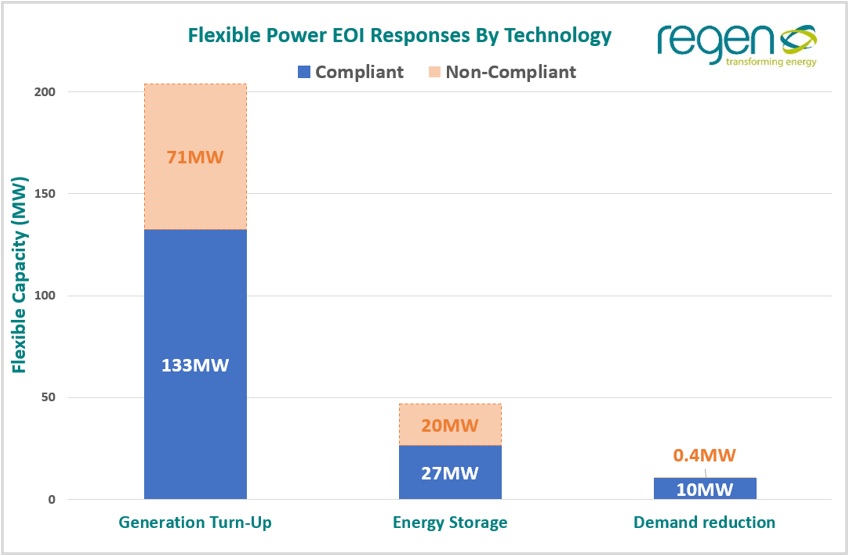

- Generation turn-up was dominant, with 79% (12 sites, 132.5 MW) of the compliant capacity

- Three of the four storage projects (27 MW) that responded were compliant, account for 16%

- In contrast, there were 58 compliant demand reduction sites, but in total only accounting for 6% (10 MW) of the compliant capacity.

The sites and capacity received are summarised in the graphs in Figure 2 and a summary of the proportion of compliant capacities by technology is shown in Figure 3.

Figure 2: WPD Flexible Power EOI response results summary (sites and MW) (source and credit: WPD)

Figure 3: WPD Flexible Power EOI compliant technology breakdown

The response received is a positive result for WPD, showing that engaged and active flexibility asset owners are interested in exploring how they can be part of this emerging local flexibility market. However, it is interesting that despite WPD’s signposting information around the location and entry requirements for flexibility services, a significant number of applications were received that either fell outside of the advertised CMZs or did not meet the entry/operating requirements.

This reasons behind this could be two-fold:

- Those parties that expressed interest, but fell outside of locational, entry or operational requirements, may have simply been seeking to engage with WPD and to flag their interest/project for future CMZs.

- For some however, the signposting information presented may not have been as widely received or understood, with applicants potentially submitting their projects more speculatively or with a general aim to target a new source of income.

The specific technology type of the EOI responses has not been made public. At this early stage of the market, it is likely that a significant proportion of dispatchable generation will be made up of diesel generators and small-scale gas turbines/engines. Over time we would like to see more storage, DSR and dispatchable renewable energy generation (AD for example) entering the market.

Regen has worked with WPD to publish a community consultation around the shift to becoming a DSO. See Figure 4. This consultation includes information and questions around the clarity of the flexibility service requirements presented. This consultation is currently open and we would welcome views and feedback from any local energy stakeholders or potential flexibility providers.

For more information and to respond to the consultation, visit WPD’s website here.

Figure 4: WPD ‘The future of our electricity network’ consultation paper and online questionnaire

Remind me what’s on offer again?

As discussed in our previous blog, the potential income that is available for an individual asset will depend upon several factors:

- The location/CMZ

- The type and scale of flexibility service

- The frequency of events in a given month/year

- The duration of both availability (standby) and utilisation (event call)

- The volume of capacity under the flexibility contract – and therefore the frequency with which an individual asset may be called upon to provide services

- Where an asset sits in the merit order of assets that are under contract

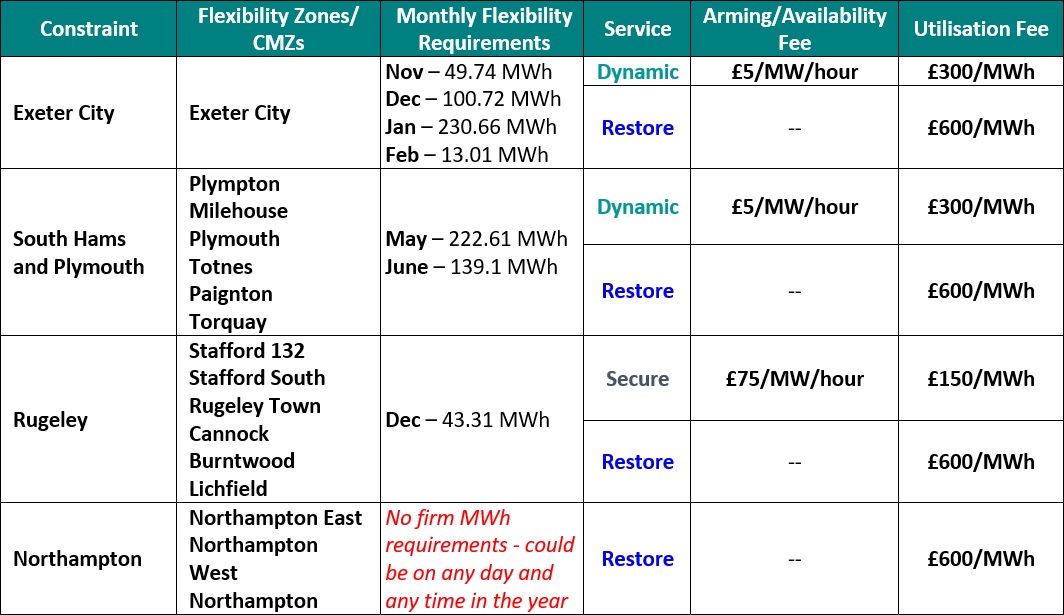

Outlined in Table 2 is a summary of WPD’s flexibility requirements, types of service and fees published for the remaining 16 CMZs, showing the notable variability as described above.

Table 2: Arming, Availability and Utilisation Fees for the remaining WPD Flexible Power zones (source: WPD)

Calculating an annual estimated income figure for a given flexible capacity is very difficult. This is due to locational differences in daily/monthly requirements, flexibility service types, prices and a general uncertainty as to the actual frequency and number of calls that will happen per month.

WPD has indicated that there will be a ‘merit order’ approach to call for flexibility services to minimise costs. Flexibility providers will therefore need to consider the frequency that their individual asset may be called upon to provide a service. This uncertainty, plus the short-term duration of contracts on offer, will very likely favour existing assets or assets that have secured other revenue streams. While DNOs would clearly prefer a ‘pay-per-use’ approach, it may be that an element of fixed payments or a minimum revenue guarantee is needed to grow the flexibility market.

However, should any potential participants wish to dig deeper into the potential revenue on offer for their project, live half-hourly capacity figures for specific CMZs this winter are available through WPD’s Network Flexibility Map. Also a detailed description of how payments are calculated is outlined in a Payment and Contract Assistant Note, which is downloadable from the Flexible Power Document library.

The 16 zones being taken forward are now open for submissions for c.8 weeks, closing on 19th September, with results aiming to be published on 3rd October.

With similar processes being instigated by UKPN, ENW and SSEN, live procurement, contracts, construction and testing could be underway in various parts of the UK by October and sites could be in operation by the end of the year. In reality and with the rapid turnaround from EOI to tender, it is likely that many of the successful sites will already be built and in operation. It would be difficult for a generation or storage project to move from a signed contract to built and operating in time for a winter operating period.

What does this all mean?

In short, the local flexibility market across the country is very much in its infancy. This year will see the first DNO EOIs move forward through to tenders and operating periods. Early movers have flagged their initial interest to participate, but the amount of flexibility that will (or can) follow through to tender and contract will almost certainly be smaller.

The results of EOI we have seen, coupled with the type of service and entry requirements published to date, allow us to draw a few conclusions:

- The local flexibility markets in their current form are likely to be dominated by dispatchable thermal generation such as gas, diesel and potentially biomass. It will be interesting to see if diesel generators can continue to participate, when considering impending exhaust emission control stipulations under the Medium Combustion Plant Directive[7].

- Renewable energy generation sites co-located with longer duration storage may be able to deliver flexibility services competitively. The potential for standalone renewable technologies such as solar and wind to participate is, however, very limited and challenging. This is due to the fact that a call to generate may come at a time when there is little or no sun or wind.

- Standalone energy storage, of various technologies, is potentially well-placed to participate, as seen in the moderate amount of storage that expressed interest in WPD’s EOI above. However, storage assets sized more for power output (MW), than longer duration energy storage capacity (MWh), might struggle to discharge for two hours or longer event calls.

- Demand reduction potentially has a role to play, but the timing, duration and verification requirements may likely skew more towards more inherently flexible industry sites. The opportunity for aggregated domestic demand to deliver services is extremely challenging when considering current low smart meter rollout progress, highly limited flexible loads in the home and the significant level of engagement that would be required to contract and operate household flexibility. However, news that Powervault has entered an agreement with UKPN to provide flexibility services in the London Borough of Barnet, through aggregating 40 8kWh home batteries is a legitimate example of smaller-scale assets supporting the local network.

Author: Ray Arrell – Senior Project Manager

[1] See UKPN Flexibility Services: https://www.ukpowernetworks.co.uk/internet/en/have-your-say/listening-to-our-connections-customers/flexibility-services.HTML

[2] See Powervault press release, June 2018: https://www.powervault.co.uk/article/powervault-to-deliver-local-flexibility-in-london-with-ukpn/

[3] See UKPN Future Smart: What our Stakeholders Said report, May 2018: https://www.ukpowernetworks.co.uk/internet/en/about-us/documents/Future-Smart-What-our-stakeholders-said.pdf

[4] See ENW Flexible Services: https://www.enwl.co.uk/innovation/our-approach/flexible-services/

[5] See Ofgem consultation, “Getting more out of our electricity networks by reforming access and forward-looking charging arrangements” (July 2018): https://www.ofgem.gov.uk/system/files/docs/2018/07/network_access_consultation_july_2018_-_final.pdf

[6] Funded under WPD’s Project ENTIRE. For more information see: http://www.flexiblepower.co.uk/Midlands-Trial.aspx and https://www.westernpower.co.uk/Innovation/Projects/Current-Projects/Project-ENTIRE.aspx

[7] See EU MCP Directive summary: http://ec.europa.eu/environment/industry/stationary/mcp.htm