Our policy lead, Madeleine, sets out our asks to government regarding tax relief during the green recovery.

Our policy lead, Madeleine, sets out our asks to government regarding tax relief during the green recovery.

Co-ordinated by Regen and the Electricity Storage Network, the major trade bodies and membership organisations representing the energy industry have come together to ask the government to provide temporary tax relief as a means of boosting the industry, giving confidence to investors and allowing shovel-ready projects to immediately come forward.

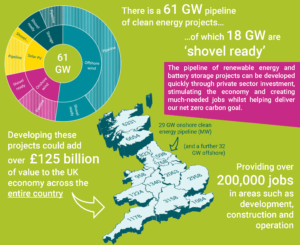

In the context of the pandemic and a green recovery, clean energy technologies could provide 3 million job-years and add over £125bn to the economy, according to our research on the green recovery. We are asking for temporary rates relief in order to jump start these projects, but also looking to longer term reform, to ensure clean technologies pay their fair share of rates.

In the context of the pandemic and a green recovery, clean energy technologies could provide 3 million job-years and add over £125bn to the economy, according to our research on the green recovery. We are asking for temporary rates relief in order to jump start these projects, but also looking to longer term reform, to ensure clean technologies pay their fair share of rates.

Tax rates are regularly flagged as a barrier to deployment of clean technologies, particularly for assets that are installed behind the meter. The business rates and VAT structure for clean technologies is complex and widely recognised to be in need of reform to facilitate the transition to net zero.

The Electricity Storage Network has been working for some time to improve the business rates calculation for storage and we have identified several examples of distortions that disadvantage storage and other clean technologies:

- Solar: supermarket chain Lidl recently installed solar PV across several of its sites, but faces a business rates increase of 530% as a result.

- Storage: a 10 MW battery storage system, if installed behind the meter, would face rates 400% higher than its grid-connected counterpart.

- Heat networks: the rateable value of heat networks amounts to £10,387 per kilometre of pipeline, against a rateable value of gas transmission and distribution networks which amounts to £2,382 per kilometre of pipeline.

Many of you will have been frustrated by the increase in VAT for small-scale solar and storage (amongst other ‘energy saving materials’) last year. We are now pushing the government to address this, particularly as the government stated that they would look at this again once the UK has left the EU, and include other technologies in this category.

We’re asking that the Treasury:

- Provides business rates relief for clean energy technologies that are playing a role in the net zero transition, whilst developing a fairer and more coherent system of business rates and VAT for renewables and storage to unlock investment

- Reinstates the VAT discount of 5% for energy saving materials and expands the definition to include storage, air-source heat pumps and EV charging equipment

We’ll also be contributing to the Treasury’s fundamental review of business rates – initially taking part in the call for evidence that will conclude in September.