Johnny Gowdy, Regen's director, reflects on the current gas price crisis and the opportunity to take advantage of the very low cost of renewable energy to make a national hedge against future energy price increases.

Johnny Gowdy, Regen's director, reflects on the current gas price crisis and the opportunity to take advantage of the very low cost of renewable energy to make a national hedge against future energy price increases.

In response to the gas price crisis, Kwasi Kwarteng, Secretary of State at the Department for Business, Energy and Industrial Strategy (BEIS), has told the House of Commons BEIS Committee, "We have to prepare for longer term higher prices". Quite right, although this does beg the question of why we haven't been prepared to date. The concept of 'price security' has now entered the lexicon of policy makers alongside 'security of supply'.

One method of maintaining price security which has come to prominence is the technique of hedging, using a financial instrument or market strategy to offset the risk of volatile price movement. In the case of energy, this means using a method to either lock in a future price or to ensure that if prices rise there is some upside value gain to offset price rise impacts.

Applying this approach to electricity, the UK government could take advantage of the very low cost of renewable energy to make a national hedge against future price increases, while at the same time delivering on the government's commitment to achieve net zero, transform the UK economy for a green future and create thousands of jobs.

The opportunity to do this quickly and effectively is sitting right in front of us with the forthcoming fourth Contract for Difference (CfD) auction. CfDs are an excellent energy price hedge.

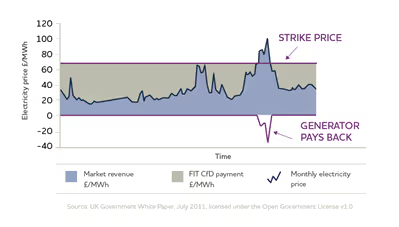

Under the terms of a CfD contract, a generator is subsidised (topped up) if the market price falls below an agreed strike price, but is obliged to make a payment back to public coffers if the market price exceeds the strike price. The generator is getting a form of revenue security, but for the energy system and the consumer this is a form of hedge. Higher prices are offset by the value recouped from generators.

While CfD strike prices were set at a high level for early offshore wind projects, and notably for the Hinkley nuclear power plant, their hedge value was limited. But as renewable costs have fallen, leading to CfD strike prices which are now trending towards the prevailing wholesale price, the likelihood of generators paying money back as contribution to the UK government has become apparent. This has now moved from a theoretical possibility to a reality, with windfarms now regularly paying money back to government.1,2

As Regen has previously highlighted the forthcoming Round 4 CfD auction represents great value for consumers, with very competitive strike prices expected for offshore wind, and for onshore wind and solar PV to be so low that they will be at, or even below, the prevailing wholesale price. At that point, rather than a revenue subsidy, the CfD mechanism is more akin to a fixed price guarantee with an upside repayment to government. There is even a collar that if prices go negative the subsidy payment ceases. So this is a very low risk option.

In fact, the main risk at the moment is that CfD auction prices may fall too low, leading to projects not being built and a wasted opportunity. Policy makers need to take care that this does not happen by ensuring that auction parameters and budgets are appropriately set.

At the moment, the government has said that it expectsto support up to 5 GW of the more established renewable technologies in the round 4 auction, mainly onshore wind and solar, for as little at £10m per annum in levy budget.3 A bargain compared to the £29.7 billion the National Audit Office estimates will be required to provide a CfD subsidy the Hinkley C nuclear power station over 35 years.4

To make a really bold hedge and commitment to net zero, we could double the target capacity at the next auction, and then commit to holding regular (annual or biannual) auctions through the coming decade. This would be a great headline in the build-up to COP and an indication that the UK is prepared to lead the race to net zero and drive forward a green recovery.

Building 10-15 GW of onshore wind and solar by 2025, would be a significant step towards the capacity needed by 2035 to decarbonise electricity and fulfil the UK net zero commitments.5

Regen's analysis suggests that there are plenty of projects in the pipeline to make up this capacity, with around 10 GW of onshore wind and solar currently with planning permission in place, and a further 9 GW in the planning system, and another 20 GW in the wider pipeline projects that have secured a transmission or distribution grid connection.6

As well as putting us on the road to net zero, this would also jump start the UK supply chain, and create thousands of jobs, after a period of deployment hiatus.

If wholesale prices stabilise, that's great - we have secured green energy at a competitive cost. But if we do see price spikes, or consistently high prices above the strike prices, then the UK would have an automatic hedge in place to recoup value from renewable from the energy market. Revenue collected could be used to reduce the environmental levies on electricity which now stand at circa 25% of the electricity bill, to directly counter price increases. Levy recovery funds could also be channelled towards alleviating fuel poverty and energy efficiency.7

Of course, electricity price hedging is not the only solution, we also need a lot more energy storage and energy efficiency, which is perhaps the best hedge that we can make for future security of supply and price rises. More on these topics to follow.

Postscript:

Thank you for the comments on this insight piece so far.

It has been pointed out that the same hedging logic also applies for corporations and public bodies taking out a long term Power Purchase Agreement for renewable energy.

Yes, this is exactly right, those that have long term PPA's in place must be glad that they did.

Councils, and other organisations, should definitely consider supporting new renewable energy projects, with a PPA set at a level that encourages project investment but also acts as a hedge against future price rises. Far better to support community and local energy generation than doing the 'greenwash shuffle' with paper REGO's while still relying on fossil fuels.

Footnotes and references

1. Imperial College https://www.imperial.ac.uk/news/200353/offshore-wind-power-cheap-could-money/

2. Even the Telegraph says so https://www.telegraph.co.uk/business/2021/08/22/wind-farms-pay-millions-back-government/

3. UK Government fourth CfD Auction draft budget https://www.gov.uk/government/publications/contracts-for-difference-cfd-draft-budget-notice-for-the-third-allocation-round

5. In any credible scenario, the UK needs around 70 GW of onshore wind and solar by 2035 to be on track for net zero and its 78% emission reduction target e.g. Committee on Climate Change Balanced Pathway Scenario.

6. Source: REPD, ECR and TEC datasets augmented by Regen analysis. There are other projects in development that are not captured by these datasets.

7. Ofgem https://www.ofgem.gov.uk/publications/infographic-bills-prices-and-profits

Sign up to receive our monthly newsletter containing industry insights, our latest research and upcoming events.